Debt Free Homestead Tips to Become Debt-Free

If you are homesteading or inspired to homestead, these debt free homesteading tips to help you become debt-free on your homestead.

This post about Debt free homestead tips may contain affiliate links, as an Amazon Associate I earn from qualifying purchases. Please read my Disclaimer for more information.

Living a debt free life is the number one tip as a homesteader that will open up more doors for you financially and help you save money homesteading.

If you are on your homesteading journey or close to having the homestead of your dreams one of the biggest challenges with this lifestyle change usually deals with money.

Table of Contents : Debt free homestead tips

Having financial security will put you in good shape and will keep you in the right direction to get your dream homestead.

Why will living debt free help you save money homesteading?

- Homesteading can be done on the cheap but in reality, If you become debt free you will free up the money you will need to do what you want on your homestead.

- Becoming debt free will allow you to get your dream property, provide you with extra income, and help you have enough money to live a self-sufficient life overall.

- Removing the stress of student loans, or owning any money to anyone will be the first step in freeing yourself to depend on society.

- Homesteading is not only about having a small farm, fruit trees, chicken coop, or growing your food, it is about having the freedom on a larger scale.

With this guide, I paid off $60,000 in 13 Months, which set me up to start my homesteading dreams.

Do you need to have Debt free homestead tips to save money on your homestead?

In my opinion, it helps!

This was a type of question and I would ask myself all the time. If you have questions on how debt-free living can help you homestead successfully, then this post will help you.

Choosing to become debt-free allows you to become self-sufficient.

Right now some homesteaders are working corporate jobs at the same time which is a lot of work..and that’s okay!

You make temporary sacrifices to help you get out of your current position, it’s to get the dream life you want..which is so worth it.

That’s my situation and it has been part of my homesteading journey like many others.

Below is my own personal story on how I became debt free that led me to start my homesteading journey.

Debt free homestead tips: My Story

First of all, if I can turn back time, I wish I would have had a different mindset about money.

But, like most people, I thought having payments was the normal thing to do.

At 18 years old I got my first credit card, by 21 I got a student loan, at 29 I had a car loan and was $60,000 in the hole.

Time flies when you’re having fun…right?

In this case, not really.

Living paycheck by paycheck and maxing out credit cards is a never-ending cycle.

I wasn’t ready to make a change until my family ended up living only on one income.

We had military orders to move 2,444 miles away and had to start over.

I had kids to feed, just gave birth, and was struggling to find a job.

My new location didn’t have my nurse specialty.

Before I moved I was a Neonatal Intensive Care Unit (NICU) nurse, and there was no NICU in our new area.

I know…just my luck. I felt like a job was out of reach.

While I was fighting hard to find anyone to give me a chance to work, I felt like my family was drowning in bills since the amount of debt we had was consuming us.

I then discovered Dave Ramsey’s principles and saw inspiring stories on YouTube of others who got out of debt.

The mix of these resources gave me the motivation I needed to tackle my debt.

You have to be ready mentally to make a change on the journey to debt-free living.

While I was gaining all this motivation, 50 applications, and 12 interviews later… I finally got a job! It was GO TIME!

I was ready to get serious and learned the most important points that helped me pay off $60,000 in 13 months.

After getting out of debt I started to stockpile money faster and eventually saved enough money to move across the county to start my homesteading dreams in Central Florida.

Debt free homestead tips

Here is a realistic STEP-BY-STEP guide that will help you have a debt free homestead and save money homesteading overall.

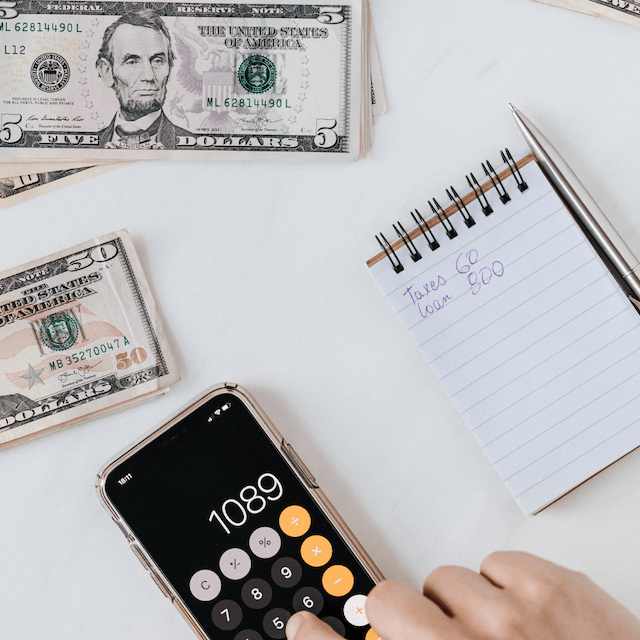

1. WRITE DOWN ALL YOUR DEBT ON PAPER TO TRACK PROGRESS

The truth hurts! You won’t know how far in debt you’re in until you go through all your accounts and write down all the money you owe on paper.

Write down your debt from smallest to largest on a piece of paper or a fun printable.

Keep this paper in a place you can see every day, like on your fridge, or tape it to a wall that you pass by in your home all the time.

When I did it, I made a visual for myself, this also made me more motivated to smash it down to $0.

Personally, I think if you have a constant reminder of your financial goals, you are more likely to accomplish them.

2. MENTALLY GET YOUR FAMILY ON BOARD…SPOUSE AND KIDS TO BECOME DEBT-FREE!

If you don’t have a spouse or kids, you can skip this step. For some, getting your spouse and kids on board with this master plan you have to pay off debt is key.

It’s important because this will affect your whole family, and they need to be aware of the changes to come.

After all, in my opinion, family is usually one of the key reasons why people leap to become debt-free. Paying off debt can give your family a better life in the long run.

- Sit your spouse down and show them all the debt-free resources that you are seeing or reading. Sometimes this is not that easy to do, and it can take a couple of days. Getting them The Total Money Makeover book can help.

- You have to be patient and approach it in a loving and caring way. Your spouse will see the passion you have to pay off debt and will at least give it a try.

- If you haven’t done this already, talk to your kids about money. I bought this Financial Peace Jr kit and simply talked to my child about how people get money, how money is spent, and saved, and what is a loan. Depending on the age of your kids, you may not need to get that in-depth. For younger kiddos, you can give them money examples that they would understand.

3. How to pay off debt fast by INCREASING INCOME

Hustle, hustle and hustle! That is the mentality you need to get this ball rolling.

If you have a job, great! Find other ways to get a little more money in your pocket, and make sure it fits into your schedule.

For example, I worked the night shift, so I ended up getting a day job working as a substitute school nurse. Here are some ideas:

- Work overtime at your job

- Have a garage sale

- Make crafts to sell

- Sell at a farmers markets

- Sell items you don’t want on Facebook Marketplace or selling apps

- If you garden, sell some of your food or other goods

- Sell unneeded cars to free yourself from car payments

4. How to pay off debt fast: BUDGET (BIWEEKLY OR MONTHLY)

Now, this is a game-changer! I don’t know about you, but before this idea of debt-free living and paying off debt, sadly I never made a money budget.

If you’re like me, making a budget this is something you are just going to have to get used to doing.

It won’t be perfect, but it at least be a guide to know what money is coming in and out.

Depending if you get paid biweekly or monthly make a budget that will fit your family. Here are some tips:

Write down how much money you use on monthly bills to see a better view of your financial situation.

- Write down a monthly budget on paper with a pen.

- Get a free money budget app (I also use the Every Dollar App, it is a great one)

- Make an Excel spreadsheet

- Get a budget notebook-This is a MUST!

Whatever you choose to do, just stay consistent on doing a budget.

It will make a huge difference in your journey to become debt-free.

5. GET RID OF OR REDUCE NON-ESSTINAL BILLS

You don’t have to sacrifice all the things that make you happy. Meanwhile, just remind yourself you can have extra things you want later. In short, here are some ideas on how to reduce bills:

- Cut off your cable

- Downgrade your cable package

- Call your cell phone company to try to lower your bill

- Call your car insurance company or any company you pay monthly to and have your bill lowered. (never hurts to try!)

Depending on what you are paying for every month, get creative on where you can cut costs. Overall, this will take some give and take, but it will be all worth it in the end.

6. STOP SUBSCRIPTIONS AS NEEDED

Do you need that new trendy subscription box you see your friends getting on social media? I don’t think so. Mentally it is all up to you and what you are willing to give up for a short period.

I promise you can have all the subscriptions you want after you debt free.

However, you might not even notice you are missing certain subscriptions after you cancel them.

Every step you take is one step closer to your financial goal.

7. FREEZE/CUT UP YOUR CREDIT CARDS

Go ahead and go to each account you have and freeze it. Most credit cards have this option on an app or website.

Depending on the type of account, you may have to take the time to call the company to do this.

Take small steps every day, so if you need to take baby steps to get to this point, that’s okay. I

n the meantime, you can hide them in a place you won’t get the urge to use them.

Whatever you do, just don’t keep them in your wallet!

8. CREATE WEEKLY MEAL PLAN/FOOD LIST

Certainly, this will save you $$$ and keep you from eating out.

Everyone can benefit from having a meal plan, and food list before going to the grocery store.

Take the time and:

- lookup recipes online

- come up with your own and log them in a recipe book

- Buy some recipe books, my favorite is Half Baked Super Simple, and any of the Magnolia cookbooks

- Plan lunches to go to work or school

9. SAVE UP TO $500-$1000 CASH FOR EMERGENCIES

Saving anything is a plus, besides this money is like a rainy-day fund that will help in any emergency.

If you can try to save up to $1000, that would be ideal.

This concept came from one of Dave Ramsey’s principles, and it really helped me out when I started my debt-free journey.

Personally, I never really had just $1000 in an account untouched, it felt comforting when I did. This is something you add to your beginning budget to start you off.

Use my free Mason jar savings tracker printable for Homesteaders to tracker for savings.

Just put a couple of dollars to the side and before you know it you will have your emergency fund.

10. AFTER SAVING UP—STOP ALL SAVING OR INVESTING ENTIRELY

In order to get your debt paid off as quickly as possible, all investing or saving should be put on hold.

This will only be for a short amount of time because as soon as you are debt-free you will give yourself a raise.

All that money that you were giving to debt can be given to your investments/savings.

But we aren’t there yet! You need every penny now so you can have more money later.

11. TRACK ALL EXPENSES WEEKLY & REBUDGET IF NEEDED

I just know that life happens so don’t be afraid if you have to re-budget.

I did this a lot, with three children, other expenses always came up.

Review your budget and move things around so you can stay on track.

No one’s budget will be perfect when they are starting off.

So don’t be so hard on yourself and re-budget as needed.

12. START SNOWBALLING YOUR DEBT

Here we go! The term “Snowballing debt,” is when you pay off your smallest debt first to largest.

You would keep paying off debt with the extra money you have after paying off each bill.

This term is from one of Dave Ramsey’s principles, and he was right!

Organizing your debt from smallest to largest by amount lets you see the progress of paying off debt over time. It worked for me!

Let’s review!

So far, your family is all on board, your income is rolling, your budget is written, you have your emergency fund, no more savings, and you’re ready to start giving every penny to the smallest debt.

Just keep giving all the extra money you have to debt. YOU GOT THIS!

13.IF YOUR EMERGENCY MONEY IS USED–REPLENISH YOUR SAVINGS

If there is a moment you end up using your emergency fund, stop paying off debt and replenish your savings money.

That’s why I said to have $500-$1000 because if you’re on a roll paying off debt, $500 would be faster to put back than $1000.

There were times when I only had $500 in my savings and kept paying off debt for a couple of months before I budgeted to put in another $500.

That’s okay!

Whatever works for your situation, do that! Nobody is perfect, and no one will scream at you if you don’t have exactly $1000 in your savings.

It is helpful to have $1000, but if you are almost at the finish line, by all means, pay it off!

Hopefully, you don’t have an emergency, but with the extra money, you will start having from paying off a debt you probably won’t need to use it.

14. How to pay off debt fast: TENTATIVE MONTHY budget

After you have paid off some debt you will have an idea on how your budget is working for you. This is the time to give yourself a tentative date when all debt will be gone.

I want you to write that date on your planner or paper and make sure you look at it every once and while.

Having a physical date kept me motivated and gave me hope that there was an endpoint of the sacrifices I was making. So go ahead, and give yourself an end date, you might be surprised if that date changes earlier than expected!

15. How to pay off debt fast: TRACK PROGRESS MONTHLY

I tracked my progress more than monthly, but I know life can get busy! So, schedule a time every month to see how your progress is going. Update your planner, or whatever you using to track your debt payoff.

Aside from my debt-free tracker, I also wrote on a calendar. I would write the dollar amount I put towards debt over each month on my calendar! This is a great way to see the big picture and take a step back to see how far you have come.

16.KEEP MOTIVATED MENTALLY… FIND YOUR CHEERLEADERS!

This is a very important step! Let’s be honest, paying off debt quickly is extremely mentally draining. Keeping mentally strong throughout this process will help you from burning out. You’re working so hard to pay off debt and take care of your family at the same time.

I get it!

Life is still happening, and there will be times that you feel like breaking down because you feel like there is no end. I say this because I had some down moments myself.

We are all humans, and our emotions can take the best of us mentally. I am a big advocate for prioritizing mental health. Here are tips to keep mentally motivated:

- Find a family member to share your progress with (mine was my mom)

- Join a Facebook group (Dave Ramsey’s Baby Step Community is a great one!)

- Find friends that build you up on your journey.

- Watch debt-free stories on YouTube (these can be very inspiring)

- Take some time a give yourself a mental-health day (pamper yourself, unwind alone at night, read a book, do yoga, exercise, etc.)

17. CELEBRATE YOUR MINI GOALS!

Reward yourself for the hard work you are doing! (don’t forget to add it to your budget) Once in a while celebrate your debt-paying goals, it won’t hurt.

When I paid off my student loan, I took my family out for dinner. It doesn’t have to be extravagant, but just a little reward to keep yourself going.

So go ahead, and celebrate your mini accomplishments along the way for debt-free living!

18. DON’T GIVE UP—THERE IS A LIGHT AT THE END OF THE TUNNEL

Remember that end date you wrote down…that day will come! KEEP GOING!

The reality is, yes there will be a downside, yes there be times you want to stop, and yes there will be times your motivation will be at an all-time low.

Don’t feel bad if you have to lean on your support person or group, they will be there for you when times get rough.

Just remember, don’t give up! YOU CAN DO THIS!

This ultimate guide on Debt free homestead tips to Save money Homesteading will help you go far in your homesteading journey.

I hope all these tips and information about Debt free homesteading tips will lead you to an amazing community of homesteaders who have done the same thing and become debt free too.

For more amazing homesteading Tips check out the posts below

5 Important Things Learned: Buying Land in Florida to Farm on

The Best Guide to Living a Modern Homesteading Life

Setting Homestead Goals | THE FIRST YEAR

Debt free homestead tips PIN FOR LATER